This report provides Transforma Insights’ view on the use of IoT in Vehicle Rental, Leasing & Sharing Management. This segment comprises two sub-applications: Vehicle Rental, Leasing & Sharing Management Head Unit and Vehicle Rental, Leasing & Sharing Management Aftermarket.

This report focuses on the remote monitoring of vehicles lent to businesses and private individuals by a third party. Third-party vehicle owners include rental car companies, vehicle finance providers, or shared car schemes. Some of the principal benefits of using remote monitoring solutions are tracking vehicle location, better estimation of maintenance requirements, and automatic logging of vehicle usage.

Although historically a market dominated by aftermarket solutions, many automotive OEMs have begun to become a part of the rental, leasing, and sharing ecosystem by offering specialised telematics services to rental and leasing companies. Even so, aftermarket devices are still preferred by rental and leasing companies with a varied fleet of vehicles that are difficult to monitor and manage with a single embedded solution. Vehicle hire companies such as Avis Budget Group, Hertz, and Europcar use integrated aftermarket devices to streamline operations and reduce costs.

The report provides a detailed definition of the sector, analysis of market development and profiles of the key vendors in the space. It also provides a summary of the current status of adoption and Transforma Insights’ ten-year forecasts for the market. The forecasts include analysis of the number of IoT connections by geography, the technologies used and revenue.

A full set of forecast data, including country-level forecasts, sector breakdowns and public/private network splits, is available through the IoT Forecast tool.

The report examines key factors that are influencing the development of the market, including:

This section of the report explains why vehicles that are deployed under car sharing, rental, and leasing schemes have high user turnover and unpredictable maintenance requirements, and how telematics can help with this. For instance, telematics devices enable easy vehicle monitoring and better estimation of maintenance requirements, allowing vehicles to remain in service for longer time periods.

It then discusses the rising demand for third-party vehicle provision as a principal driver behind the adoption of these devices (mostly due to increasing vehicle ownership cost owing to factors like rising insurance costs, emission taxes, and others), which justifies car sharing or renting to be more cost-effective options.

This subsection first explains car rental in general terms and discusses why traditional rental cars are being increasingly connected. It then expounds upon the popularity of car rental in tourist destinations such as the US and Europe, and also talks about car sharing services and ride-hailing services such as Uber limiting the scope of traditional rental services market.

This subsection explains car sharing and its general features (including enabling occasional use of a vehicle or access to different brands of vehicles). It has been further categorised into the following:

This subsection discusses how shared car schemes have been a valuable contributor to the Vehicle Rental, Leasing & Sharing management market, especially in urban regions - owing to factors like congestion and parking issues, which has significantly reduced vehicle ownership in urban environments. For instance, 42% of households in London have no private vehicles. It also explains the growing push for electric vehicles as another driver behind the increased usage of shared vehicles in urban areas.

This subsection explains how an increasing focus on sustainability has generated considerable interest in vehicle-sharing schemes since it reduces the number of private vehicles on roads and encourages people to walk or cycle for short-distance journeys.

This subsection focuses on how the increasing number of autonomous cars can boost car rental and sharing services. Since autonomous cars do not involve human drivers, it is also easier for consumers to pick up a vehicle wherever the previous user parked it and then sit, navigate the app, and drive away directly.

This subsection first defines peer-to-peer renting and explains why owners who choose to share their vehicles may also choose to use embedded and aftermarket tracking and telematics devices. It also highlights how autonomous cars are likely to add a new dimension to the P2P rental market (since they don’t have drivers and the owners do not have to be involved in the delivery and collection of vehicles).

This subsection charts the barriers that may hinder the growth of the rental and sharing market including uncertainty surrounding the new business models and privacy concerns. It also mentions some regulations regarding the same. For example, in the US, California’s law bans the use of electronic surveillance in rental vehicles unless it’s used to locate a missing vehicle or log data points at the start or end of a rental agreement.

This subsection explains the usefulness of telematics devices for leased vehicles. It claims that since vehicles are leased for several years by users, monitoring them becomes a challenge for vehicle owners. In this context, telematics solutions can be used to ensure that lease agreements have been duly complied with, warn users about fines, and ensure that service schedules are properly adhered to.

It also highlights the major differences between purchasing and leasing, and charts the factors that have made leasing a popular option for new vehicle purchases. It also explains how rising interest rates since the pandemic have reduced the number of new vehicles that are leased. For instance, the total number of leased new vehicles reduced from 33% in 2020 to 17% by January 2023.

It also talks about some organisations (like Volvo), that are offering vehicles on a subscription basis, and explains how this is different from traditional leasing. It also discusses the scope of the subscription model (like attracting customers who don’t need vehicles permanently) and its benefits (like resulting in more third-party vehicle ownership, many of which will be making use of an embedded telematics solution to monitor their use).

This section claims that since it’s a relatively new area for OEMs, most solutions in this market are currently aftermarket, and discusses the benefits of embedding these services. It also explains why OEMs are more incentivised to adopt their own embedded solution, instead of an aftermarket solution (including cost savings and improved hardware integration).

In a tabular form, the report then compares various OEM-backed solutions for vehicle rental, leasing, and sharing management companies (including Ford, General Motors, Stellantis, Renault-Nissan-Mitsubishi, Toyota, and Daimler). It also provides a few examples of relevant IoT deployments in this application, including Free2move collaborating with Samsara to enhance commercial fleet efficiency.

This section explains why companies that operate in the vehicle rental, leasing, and sharing industry prefer using aftermarket devices from a single vendor across as many vehicles as they can. It also discusses the connectivity technology used by these aftermarket devices and their benefits (including gaining insights about the vehicles – like trip detection).

It also provides an example of relevant IoT deployment in this application - Europcar using real-time telematics in collaboration with Geotab and Telefonica.

The key vendors section lists some of the main providers of products and services related to the market such as Targa Telematics, CalAmp, Octo Telematics, Webfleet, Geotab, and Zubie. The report provides profiles of the various vendors including aspects most relevant to this Application Group, such as product offerings, pricing, financial results, and technology.

In the market forecasts section, we provide a summary of the forecasts from the Transforma Insights IoT Forecast Database:

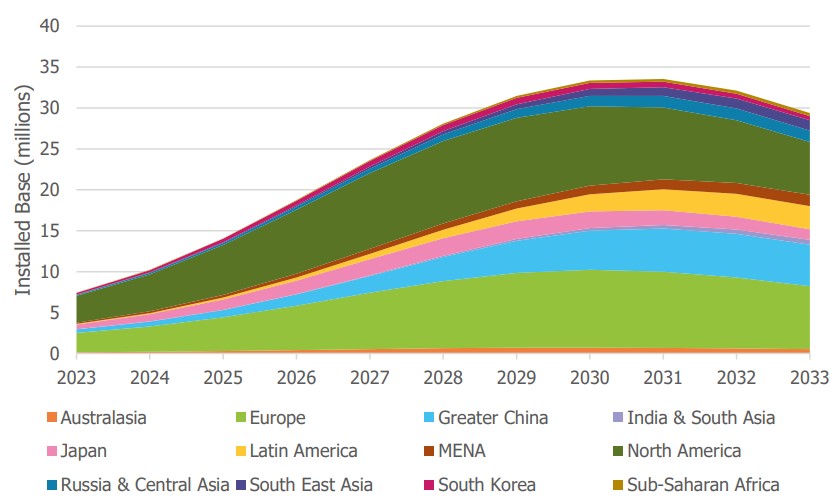

The report charts the growth in the number of devices which will grow from 7.4 million in 2023 to 29.4 million in 2033. Transforma Insights forecasts are compiled on a country-by-country basis. This report includes a regional summary, showing splits between Australasia, Greater China, North America, Europe, Japan, Latin America, MENA, Russia & Central Asia, South East Asia, South Korea, India & South Asia, and Sub-Saharan Africa.

Transforma Insights’ IoT forecasts include splits between the various connectivity technologies as follows: 2G, 3G, 4G, 5G mMTC, 5G non-mMTC, LPWA (non-mMTC), Satellite, Short Range, and Other.

This section discusses which technologies will be used in the Vehicle Rental, Leasing & Sharing Management Application Group.

This part of the report discusses the market growth in terms of revenue (module revenue, service wrap revenue, and VAC revenue). Transforma Insights estimates that the revenue in the Vehicle Rental, Leasing & Sharing Management Application Group will grow at a CAGR of 25%.