This report provides Transforma Insights’ view on the IoT market for Loss Prevention, predominantly in retail. This segment comprises two applications: Boundary Control and Goods Location Monitoring. Essentially, Boundary Control solutions include hard tags, ceiling-mounted and pedestal systems, detachers, deactivators, and labels. Goods Location Control includes the use of GPS trackers generally hidden inside high-value goods.

Brick-and-mortar businesses are facing a challenge to deter theft and protect them from financial losses. In 2021, US retailers witnessed USD95 billion worth of financial losses due to retail theft. Retailers are increasingly adopting multiple technologies and security solutions to protect their goods from internal and external theft.

The use of Boundary Control and Goods Location Monitoring is essentially employed as a part of retail loss prevention strategies. Businesses implement tags, labels, and GPS trackers to mitigate theft. Also, businesses gain better inventory visibility throughout their supply chains. This can help in identifying out-of-stock goods in retail outlets, which can impact stores’ revenue.

The report provides a detailed definition of the sector, analysis of market development and profiles of the key vendors in the space. It also provides a summary of the current status of adoption and Transforma Insights’ ten-year forecasts for the market. The forecasts include analysis of the number of IoT connections by geography, the technologies used and revenue.

A full set of forecast data, including country-level forecasts, sector breakdowns and public/private network splits, is available through the IoT Forecast tool.

This section begins with a general figure about retail theft in brick-and-mortar businesses and its detrimental effects (like costing businesses financially and physically injuring stores’ employees).

The report then examines the key factors that are influencing the development of the market, including:

This section of the report discusses the multiple security solutions that brick-and-mortar businesses deploy to strengthen their in-store security (like more security personnel and RFID-based tags on goods, and storing costly items in locked cabinets). It also explains why tag-based systems are preferred more than storing goods in locked cabinets.

This subsection explains different types of RFID-based systems that can be deployed (including pedestal systems, concealed systems, and metal foil detection systems) along with their features, benefits, and challenges (in a few of them). For instance, although some concealed systems can be hidden behind ceilings, which reduces visual disruptions of detection systems, it also negates the visual deterrent of alternative systems.

This subsection focuses on retailers embedding RFID chips into price tags to monitor and track merchandise and discusses the multiple benefits of doing the same. For instance, the data captured help businesses gain better inventory visibility, which can help in identifying out-of-stock goods, eventually increasing the stores’ revenue. Besides, RFID-based tags can ensure faster checkout at retail outlets, improving customers’ satisfaction levels.

This subsection lists some retailers (such as Lowe’s, The Home Depot, Macy’s, and Walmart) and talks about the initiatives taken by them to reduce loss in retail stores. For instance, Macy’s uses smart exit gate sensors to read tagged goods’ unique serial numbers and determine if the product is stolen.

This subsection first defines Organised Retail Crime (which costed US retailers USD70 billion in 2020) and then discusses the strategies undertaken by governments and businesses to reduce retail theft. For example, the US government has significantly reduced ORC cases by limiting thieves' online selling opportunities.

This subsection discusses the variety of connected devices that retailers have started to deploy (including hard tags, ceiling-mounted pedestal systems, detachers, deactivators, and labels). It then discusses how BLE-enabled devices are also being deployed now, in addition to RFID tags. It also talks about the benefits of BLE-based asset tracking systems, like streamlining logistics and optimising inventory management. It then shifts its focus to the use of Ambient IoT tags and their advantages (like being very cheap and reducing the need for batteries to be charged or swapped).

It also provides some examples of relevant IoT deployments in this application, like Adidas installing Nedap’s RFID-based solution to prevent in-store theft and Pimkie installing RFID tags at its store for loss prevention.

This section first justifies the use of GPS trackers for high-valued goods owing to reasons like increasing incidents of robberies and rising inflation. It then talks about the benefits of these GPS trackers (like providing text notifications) and the connectivity technologies used by them (including Cellular, Wi-Fi, and Bluetooth). It also refers to the connectivity technologies (such as LPWA) which are used in Goods Location Monitoring solutions and explains why LPWA will become the most suitable choice for tracking stolen goods (both high-valued as well as low-valued goods).

It also provides an example of relevant IoT deployment in this application - Mac’s Convenience Stores using 3SI Security tobacco GPS trackers for tracking stolen goods.

The key vendors section lists some of the main providers of products and services related to the market, such as 3SI Security, Cybra, Zebra Technologies, Sensormatic by Johnson Controls, Sensormatic by Johnson Controls, and Brickhouse Security. The report provides profiles of the various vendors including aspects most relevant to this Application Group, such as product offerings, pricing, financial results, and technology.

In the market forecasts section, we provide a summary of the forecasts from the Transforma Insights IoT Forecast Database:

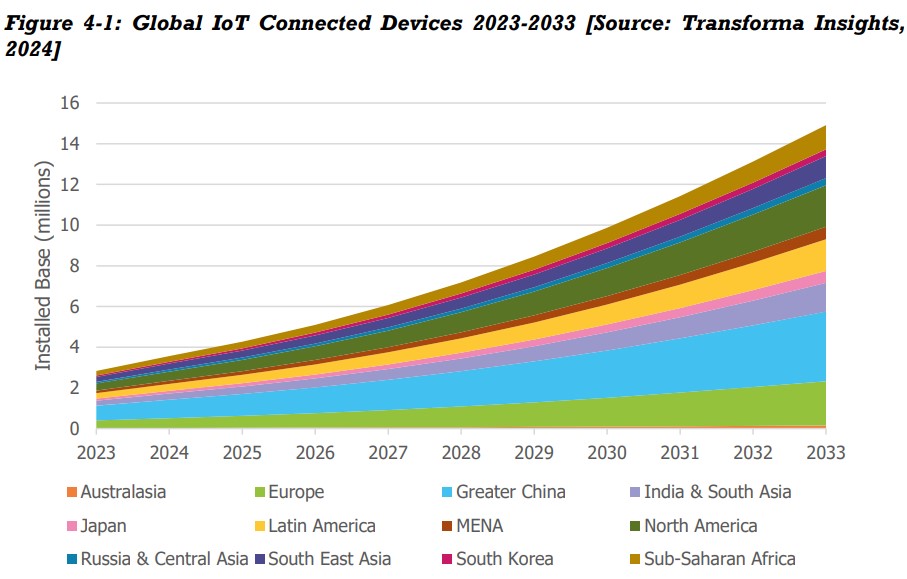

The report charts the growth in the number of devices which will grow from 2.8 million in 2023 to 14.9 million in 2033. Transforma Insights forecasts are compiled on a country-by-country basis. This report includes a regional summary, showing splits between Australasia, Greater China, North America, Europe, Japan, Latin America, MENA, Russia & Central Asia, South East Asia, South Korea, India & South Asia, and Sub-Saharan Africa.

Transforma Insights’ IoT forecasts include splits between the various connectivity technologies as follows: 2G, 3G, 4G, 5G mMTC, 5G non-mMTC, LPWA (non-mMTC), Satellite, Short Range, and Other.

This section discusses which technologies will be used in the Loss Prevention Application Group.

This part of the report discusses the market growth in terms of revenue (module revenue, service wrap revenue, and VAC revenue). Transforma Insights estimates that the revenue in the Loss Prevention Application Group will grow at a CAGR of 13%.